Property reviews to guide your next move

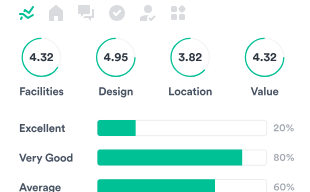

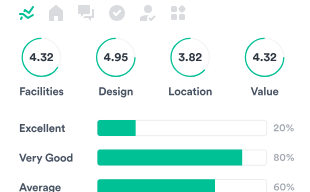

Verified resident reviews for new build homes to rent and buy

Explore by area

Find area guides and top rated homes for any region.

Featured companies

Featured developments

Loading

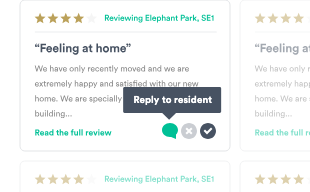

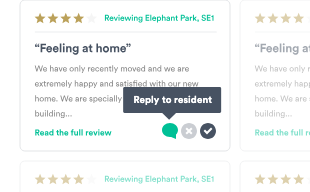

Recent reviews

Find area guides and top rated homes for any region.

Loading